Unit 2 Technology, population, and growth

Themes and capstone units

How improvements in technology happen, and how they sustain growth in living standards

- Economic models help explain the Industrial Revolution, and why it started in Britain.

- Wages, the cost of machinery, and other prices all matter when people make economic decisions.

- In a capitalist economy, innovation creates temporary rewards for the innovator, which provide incentives for improvements in technology that reduce costs.

- These rewards are destroyed by competition once the innovation diffuses throughout the economy.

- Population, the productivity of labour, and living standards may interact to produce a vicious circle of economic stagnation.

- The permanent technological revolution associated with capitalism allowed some countries to make a transition to sustained growth in living standards.

In 1845, a mysterious disease appeared for the first time in Ireland. It caused potatoes to rot in the ground, but by the time it became clear that a plant was infected, it was too late. The ‘potato blight’, as it became known, devastated Irish food supplies for the rest of the decade. Starvation spread. By the time the Irish famine ended, about a million people out of an initial total of 8.5 million had died, which in percentage terms is equivalent to the mortality suffered by Germany through defeat in the Second World War.

The Irish famine sparked a worldwide relief effort. Former slaves in the Caribbean, convicts in Sing Sing prison in New York, Bengalis both rich and poor, and Choctaw Native Americans all donated money, as did celebrities such as the Ottoman Sultan Abdulmecid and Pope Pius IX. Then, as now, ordinary people felt empathy for others who were suffering, and acted accordingly.

But many economists were much more hard-hearted. One of the best-known, Nassau Senior, consistently opposed British government famine relief, and was reported by a horrified Oxford University colleague as saying that ‘he feared the famine of 1848 in Ireland would not kill more than a million people, and that would scarcely be enough to do much good.’

Senior’s views are morally repulsive, but they did not reflect a genocidal desire to see Irish men and women die. Instead, they were a consequence of one of the most influential economic doctrines of the early nineteenth century, Malthusianism. This was a body of theory developed by an English clergyman, Thomas Robert Malthus, in An Essay on the Principle of Population, first published in 1798.1

Malthus held that a sustained increase in income per capita would be impossible.

His logic was that, even if technology improved and raised the productivity of labour, people would still have more children as soon as they were somewhat better off. This population growth would continue until living standards fell to subsistence level, halting the population increase. Malthus’ vicious circle of poverty was widely accepted as inevitable.

There is evidence that Victorian colonial administrators thought that famine was nature’s response to overbreeding. Mike Davis argues that their attitudes caused an avoidable and unprecedented mass extinction, which he calls a ‘cultural genocide’.2

It provided an explanation of the world in which Malthus lived, in which incomes might fluctuate from year to year or even century to century, but not trend upwards. This had been the case in many countries for at least 700 years before Malthus published his essay, as we saw in Figure 1.1a.

Unlike Adam Smith, whose book The Wealth of Nations had appeared just 22 years earlier, Malthus did not offer an optimistic vision of economic progress—at least as far as ordinary farmers or workers were concerned. Even if people succeeded in improving technology, in the long run the vast majority would earn enough from their jobs or their farms to keep them alive, and no more.

- Industrial Revolution

- A wave of technological advances and organizational changes starting in Britain in the eighteenth century, which transformed an agrarian and craft-based economy into a commercial and industrial economy.

But in Malthus’ lifetime something big was happening all around him, changes that would soon allow Britain to escape from the vicious circle of population growth and income stagnation that he described. The change that had sprung Britain from the Malthusian trap, and would do the same for many countries in the 100 years that followed, is known as the Industrial Revolution—an extraordinary flowering of radical invention that allowed the same output to be produced with less labour.

In textiles, the most famous inventions involved spinning (traditionally carried out by women known as spinsters, meaning female spinner, a term which has come to mean an older unmarried woman), and weaving (traditionally carried out by men). In 1733, John Kay invented the flying shuttle, which greatly increased the amount a weaver could produce in an hour. This increased the demand for the yarn that was used in weaving to the point where it became difficult for spinsters to produce sufficient quantities using the spinning wheel technology of the day. James Hargreaves’ spinning jenny, introduced in 1764, was a response to this problem.

- general-purpose technologies

- Technological advances that can be applied to many sectors, and spawn further innovations. Information and communications technology (ICT), and electricity are two common examples.

Technological improvements in other areas were equally dramatic. James Watt’s steam engine, introduced at the same time as Adam Smith published The Wealth of Nations, was a typical example. These engines were gradually improved over a long period of time and were eventually used across the economy: not just in mining, where the first steam engine powered water pumps, but also in textiles, manufacturing, railways and steamships. They are an example of what is termed a general-purpose innovation or technology. In recent decades the most obvious equivalent is the computer.

Coal played a central role in the Industrial Revolution, and Great Britain had a lot of it. Prior to the Industrial Revolution, most of the energy used in the economy was ultimately produced by edible plants, which converted sunlight into food for both animals and people, or by trees whose wood could be burned or transformed into charcoal. By switching to coal, humans were able to exploit a vast reserve of what is effectively stored sunlight. The cost has been the environmental impact of burning fossil fuels, as we saw in Unit 1 and will return to in Unit 20.

These inventions, alongside other innovations of the Industrial Revolution, broke Malthus’ vicious circle. Advances in technology and the increased use of non-renewable resources raised the amount that a person could produce in a given amount of time (productivity), allowing incomes to rise even as the population was increasing. And as long as technology continued improving quickly enough, it could outpace the population growth that resulted from the increased income. Living standards could then rise. Much later, people would prefer smaller families, even when they earned enough to afford to have a lot of children. This is what happened in Britain, and later in many parts of the world.

Figure 2.1 Real wages over seven centuries: Wages of craftsmen (skilled workers) in London (1264–2001), and the population of Britain.

Robert C. Allen. 2001. ‘The Great Divergence in European Wages and Prices from the Middle Ages to the First World War’. Explorations in Economic History 38 (4): pp. 411–447; Stephen Broadberry, Bruce Campbell, Alexander Klein, Mark Overton and Bas van Leeuwen. 2015. British Economic Growth, 1270–1870, Cambridge University Press.

Figure 2.1 shows an index of the average real wage (the money wage in each year, adjusted for changes in prices) of skilled craftsmen in London from 1264 to 2001, plotted together with the population of Britain over the same period. There is a long period in which living standards were trapped according to Malthusian logic, followed by a dramatic increase after 1830. You can see that at the time both were increasing.

Index of real wages

The term ‘index’ means the value of some quantitative amount relative to its value at some other time (the reference period) which is usually normalized to 100.

The term ‘real’ means that the money wage (say, six shillings per hour at the time) in each year has been adjusted to take account of changes in prices over time. The result represents the real buying power of the money the workers earned.

The reference year is 1850 in this case, but the curve would have the same shape if any other year had been selected. It would be positioned higher or lower, but would still look like our familiar hockey stick.

Question 2.1 Choose the correct answer(s)

Figure 2.1 shows an index of average real wages of skilled workers in London between 1264 and 2001. What can we conclude from this graph?

- This is a graph of an index of real wages. The index is approximately 100 in 1408, but this does not tell us what the money wage was.

- The wages graphed are real wages, so are adjusted to take account of changes in prices.

- Whilst the graph looks fairly constant between 1264 and 1850 compared to the rapid increase since 1850, the average real wage actually almost doubled and then halved again between 1264 and 1600 (look at the scale on the vertical axis).

- In 1850, the real wage index was approximately 100. By 2001, the index had increased by roughly six times that value, to more than 700.

Why did the spinning jenny, the steam engine, and a cluster of other inventions emerge and spread across the economy in Britain at this time? This is one of the most important questions in economic history, and historians continue to argue about it.

In this unit we examine one explanation of how these improvements in technology came about, and why they first occurred in Britain only, and during the eighteenth century. We will also explore why the long flat part of Figure 2.1’s hockey stick proved so hard to escape not only in Britain, but also throughout the world in the 200 years that followed. We will do this by building models: simplified representations that help us to understand what is going on by focusing attention on what is important. Models will help us understand both the kink in the hockey stick and the long flat handle.

2.1 Economists, historians, and the Industrial Revolution

Why did the Industrial Revolution happen first in the eighteenth century, on an island off the coast of Europe?

The following sections of this unit present one model for the sudden and dramatic rise in living standards that began in eighteenth century Britain. Based on arguments from Robert Allen, an economic historian, this model gives a central role to two features of Britain’s economy at the time. In this account, the relatively high cost of labour, coupled with the low cost of local energy sources, drove the structural changes of the Industrial Revolution.3

What we call the Industrial Revolution was more than just the breaking of the Malthusian cycle: it was a complex combination of inter-related intellectual, technological, social, economic and moral changes. Historians and economists disagree about the relative importance of each of these elements, and have wrestled with explanations for the primacy of Britain, and Europe more generally, ever since their revolutions began. Allen’s explanation is far from the only one.

- Joel Mokyr, who has worked extensively on the history of technology, claims that the real sources of technological change are to be found in Europe’s scientific revolution and its Enlightenment of the century before. For Mokyr, this period brought the development of new ways to transfer and transform elite scientific knowledge into practical advice and tools for the engineers and skilled artisans, who used it to build the machines of that time. He claims that, while wages and energy prices might tilt the direction of invention in one direction or another, they are more like a steering wheel than the motor of technological progress.4

- David Landes, a historian, emphasizes the political and cultural characteristics of nations as a whole (Mokyr, in contrast, focuses on artisans and entrepreneurs). He suggests European countries pulled ahead of China because the Chinese state was too powerful and stifled innovation, and because Chinese culture at the time favoured stability over change.5

- Gregory Clark, an economic historian, also attributes Britain’s take-off to culture. But for Clark, the keys to success were cultural attributes such as hard work and savings, which were passed on to future generations. Clark’s argument follows a long tradition that includes the sociologist Max Weber, who saw the Protestant countries of northern Europe, where the Industrial Revolution began, as the particular home of virtues associated with the ‘spirit of capitalism’.6

- Kenneth Pomeranz, a historian, claims that superior European growth after 1800 was more due to the abundance of coal in Britain than to any cultural or institutional differences with other countries. Pomeranz also argues that Britain’s access to agricultural production in its New World colonies (especially sugar and its by-products) fed the expanding class of industrial workers, thus helping them to escape the Malthusian trap.7

Scholars will probably never completely agree about what caused the Industrial Revolution. One problem is that this change happened only once, which makes it more difficult for social scientists to explain. Also, the European take-off was probably the result of a combination of scientific, demographic, political, geographic and military factors. Several scholars argue that it was partly due to interactions between Europe and the rest of the world too, not just due to changes within Europe.

Historians like Pomeranz tend to focus on peculiarities of time and place. They are more likely to conclude that the Industrial Revolution happened because of a unique combination of favourable circumstances (they may disagree about which ones).

Economists like Allen are more likely to look for general mechanisms that can explain success or failure across both time and space.

Economists have much to learn from historians, but often a historian’s argument is not precise enough to be testable using a model (the approach we will use in this unit). On the other hand, historians may regard economists’ models as simplistic, ignoring important historical facts. This creative tension is what makes economic history so fascinating.

If you want to know what these researchers think of each other’s work, try searching for ‘Gregory Clark review Joel Mokyr’ or ‘Robert Allen review Gregory Clark’.

Recently, economic historians have made progress in quantifying economic growth over the very long run. Their work helps clarify what happened, which makes it easier for us to think about why it happened. Some of their work involves comparing real wages in countries over the long run. This has involved collecting both wages and the prices of goods that workers consumed. An even more ambitious series of projects has calculated GDP per capita back to the Middle Ages.

We will focus on the economic conditions that contributed to Britain’s take-off, but each economy that broke out of the Malthusian trap took a different escape route. The national trajectories of the early followers were influenced in part by the dominant role that Britain had come to play in the world economy. Germany, for example, could not compete with Britain in textiles, but the government and large banks played a major role in building steel and other heavy industries. Japan outcompeted even Britain in some Asian textile markets, benefiting from the isolation it enjoyed by the sheer distance from the earlier starters (which in those days was weeks of travel).

Japan selectively copied both technology and institutions, introducing the capitalist economic system while retaining many traditional Japanese institutions including rule by an emperor, which would last until the Japanese defeat in the Second World War.

India and China provide even greater contrasts. China experienced the capitalist revolution when the Communist Party led a transition away from the centrally planned economy, the antithesis of capitalism that the Party itself had implemented. India, by contrast, is the first major economy in history to have adopted democracy, including universal voting rights, prior to its capitalist revolution.

As we saw in Unit 1, the Industrial Revolution did not lead to economic growth everywhere. Because it originated in Britain, and spread only slowly to the rest of the world, it also implied a huge increase in income inequality between countries. Looking at economic growth around the world in the nineteenth and twentieth centuries, David Landes once asked: ‘Why are we so rich and they so poor?’8

By ‘we’, he meant the rich societies of Europe and North America. By ‘they’ he meant the poorer societies of Africa, Asia and Latin America. Landes suggested, a little mischievously, that there were basically two answers to this question:

One says that we are so rich and they so poor because we are so good and they so bad; that is, we are hardworking, knowledgeable, educated, well governed, efficacious, and productive, and they are the reverse. The other says that we are so rich and they so poor because we are so bad and they so good: we are greedy, ruthless, exploitative, aggressive, while they are weak, innocent, virtuous, abused, and vulnerable.

If you think that the Industrial Revolution happened in Europe because of the Protestant Reformation, or the Renaissance, or the scientific revolution, or the development of superior private property rights, or favourable government policies, then you are in the first camp. If you think that it happened because of colonialism, or slavery, or the demands of constant warfare, then you are in the second.

You will notice that these are all non-economic forces that, according to some scholars, had important economic consequences. You can probably also see how the question of which of Landes’s two answers is right might become ideologically charged although, as Landes points out, ‘It is not clear … that one line of argument necessarily precludes the other.’

2.2 Economic models: How to see more by looking at less

What happens in the economy depends on what millions of people do, and how their decisions affect the behaviour of others. It would be impossible to understand the economy by describing every detail of how they act and interact. We need to be able to stand back and look at the big picture. To do this, we use models.

To create an effective model we need to distinguish between the essential features of the economy that are relevant to the question we want to answer, which should be included in the model, and unimportant details that can be ignored.

- flow

- A quantity measured per unit of time, such as annual income or hourly wage.

Models come in many forms—and you have seen three of them already in Figures 1.5, 1.8 and 1.12 in Unit 1. For example, Figure 1.12 illustrated that economic interactions involve flows of goods (for example when you buy a washing machine), services (when you purchase haircuts or bus rides), and also people (when you spend a day working for an employer).

Figure 1.12 was a diagrammatic model illustrating the flows that occur within the economy, and between the economy and the biosphere. The model is not ‘realistic’—the economy and the biosphere don’t look anything like it—but it nevertheless illustrates the relationships among them. The fact that the model omits many details—and in this sense is unrealistic—is a feature of the model, not a bug.

Malthus’ explanation of why improvements in technology could not raise living standards was also based on a model: a simple description of the relationships between income and population.

Some economists have used physical models to illustrate and explore how the economy works. For his 1891 PhD thesis at Yale University, Irving Fisher designed a hydraulic apparatus (Figure 2.2) to represent flows in the economy. It consisted of interlinked levers and floating cisterns of water to show how the prices of goods depend on the amount of each good supplied, the incomes of consumers, and how much they value each good. The whole apparatus stops moving when the water levels in the cisterns are the same as the level in the surrounding tank. When it comes to rest, the position of a partition in each cistern corresponds to the price of each good. For the next 25 years he would use the contraption to teach students how markets work.

Figure 2.2 Irving Fisher’s sketch of his hydraulic model of economic equilibrium (1891).

William C. Brainard and Herbert E. Scarf. 2005. ‘How to Compute Equilibrium Prices in 1891’. American Journal of Economics and Sociology 64 (1): pp. 57–83

How models are used in economics

Fisher’s study of the economy illustrates how all models are used:

- First he built a model to capture the elements of the economy that he thought mattered for the determination of prices.

- Then he used the model to show how interactions between these elements could result in a set of prices that did not change.

- Finally he conducted experiments with the model to discover the effects of changes in economic conditions: for example, if the supply of one of the goods increased, what would happen to its price? What would happen to the prices of all of the other goods?

Irving Fisher’s doctoral dissertation represented the economy as a big tank of water, but he wasn’t an eccentric inventor. On the contrary, his machine was described by Paul Samuelson, himself one of the greatest economists of the twentieth century, as the ‘greatest doctoral dissertation in economics ever written’. Fisher went on to become one of the most highly regarded economists of the twentieth century, and his contributions formed the basis of modern theories of borrowing and lending that we will describe in Unit 10.

- equilibrium

- A model outcome that is self-perpetuating. In this case, something of interest does not change unless an outside or external force is introduced that alters the model’s description of the situation.

Fisher’s machine illustrates an important concept in economics. An equilibrium is a situation that is self-perpetuating, meaning that something of interest does not change unless an outside or external force for change is introduced that alters the model’s description of the situation. Fisher’s hydraulic apparatus represented equilibrium in his model economy by equalizing water levels, which represented constant prices.

- subsistence level

- The level of living standards (measured by consumption or income) such that the population will not grow or decline.

We will use the concept of equilibrium to explain prices in later units, but we will also apply it to the Malthusian model. An income at subsistence level is an equilibrium because, just like differences in the water levels in the various cisterns in Fisher’s machine, movements away from subsistence income are self-correcting: they automatically lead back to subsistence income as population rises.

Note that equilibrium means that one or more things in the model are constant. It does not need to mean that nothing changes. For example, we might see an equilibrium in which GDP or prices are increasing, but at a constant rate.

Although it is unlikely that you will build a hydraulic model for yourself, you will work with many existing models on paper or on a screen, and sometimes create your own models of the economy.

When we build a model, the process follows these steps:

- We construct a simplified description of the conditions under which people take actions.

- Then we describe in simple terms what determines the actions that people take.

- We determine how each of their actions affects each other.

- We determine the outcome of these actions. This is often an equilibrium (something is constant).

- Finally, we try to get more insight by studying what happens to certain variables when conditions change.

Economic models

A good model has four attributes:

- It is clear: It helps us better understand something important.

- It predicts accurately: Its predictions are consistent with evidence.

- It improves communication: It helps us to understand what we agree (and disagree) about.

- It is useful: We can use it to find ways to improve how the economy works.

Economic models often use mathematical equations and graphs as well as words and pictures.

Mathematics is part of the language of economics, and can help us to communicate our statements about models precisely to others. Much of the knowledge of economics, however, cannot be expressed by using mathematics alone. It requires clear descriptions, using standard definitions of terms.

We will use mathematics as well as words to describe models, usually in the form of graphs. If you want, you will also be able to look at some of the equations behind the graphs. Just look for the references to our Leibniz features in the margins.

A model starts with some assumptions or hypotheses about how people behave, and often gives us predictions about what we will observe in the economy. Gathering data on the economy, and comparing it with what a model predicts, helps us to decide whether the assumptions we made when we built the model—what to include, and what to leave out—were justified.

Governments, central banks, corporations, trade unions, and anyone else who makes policies or forecasts use some type of simplified model.

Bad models can result in disastrous policies, as we will see later. To have confidence in a model, we need to see whether it is consistent with evidence.

We will see that our economic models of the vicious circle of Malthusian subsistence living standards and the permanent technological revolution pass this test—even though they leave many questions unanswered.

Exercise 2.1 Designing a model

For a country (or city) of your choice, look up a map of the railway or public transport network.

Much like economic models, maps are simplified representations of reality. They include relevant information, while abstracting from irrelevant details.

- How do you think the designer selected which features of reality to include in the map you have selected?

- In what way is a map not like an economic model?

2.3 Basic concepts: Prices, costs, and innovation rents

- ceteris paribus

- Economists often simplify analysis by setting aside things that are thought to be of less importance to the question of interest. The literal meaning of the expression is ‘other things equal’. In an economic model it means an analysis ‘holds other things constant’.

- incentive

- Economic reward or punishment, which influences the benefits and costs of alternative courses of action.

- relative price

- The price of one good or service compared to another (usually expressed as a ratio).

- economic rent

- A payment or other benefit received above and beyond what the individual would have received in his or her next best alternative (or reservation option). See also: reservation option.

In this unit, we are going to build an economic model to help explain the circumstances under which new technologies are chosen, both in the past and in contemporary economies. We use four key ideas of economic modelling:

- Ceteris paribus and other simplifications help us focus on the variables of interest. We see more by looking at less.

- Incentives matter, because they affect the benefits and costs of taking one action as opposed to another.

- Relative prices help us compare alternatives.

- Economic rent is the basis of how people make choices.

Part of the process of learning to do economics involves learning a new language. The terms below will recur frequently in the units that follow, and it is important to learn how to use them precisely and with confidence.

Ceteris paribus and simplification

As is common in scientific inquiry, economists often simplify an analysis by setting aside things that are thought to be of less importance to the question of interest, by using the phrase ‘holding other things constant’ or, more often, the Latin expression ceteris paribus, meaning ‘other things equal’. For example, later in the course we simplify an analysis of what people would choose to buy by looking at the effect of changing a price—ignoring other influences on our behaviour like brand loyalty, or what others would think of our choices. We ask: what would happen if the price changed, but everything else that might influence the decision was the same. These ceteris paribus assumptions, when used well, can clarify the picture without distorting the key facts.

When we study the way that a capitalist economic system promotes technological improvements, we will look at how changes in wages affect firms’ choice of technology. For the simplest possible model we ‘hold constant’ other factors affecting firms. So we assume:

- Prices of all inputs are the same for all firms.

- All firms know the technologies used by other firms.

- Attitudes towards risk are similar among firm owners.

Exercise 2.2 Using ceteris paribus

Suppose you build a model of the market for umbrellas, in which the predicted number of umbrellas sold by a shop depends on their colour and price, ceteris paribus.

- The colour and the price are variables used to predict sales. Which other variables are being held constant?

Which of the following questions do you think this model might be able to answer? In each case, suggest improvements to the model that might help you to answer the question.

- Why are annual umbrella sales higher in the capital city than in other towns?

- Why are annual umbrella sales higher in some shops in the capital city than others?

- Why have weekly umbrella sales in the capital city risen over the last six months?

Incentives matter

Why did the water in Fisher’s hydraulic economy machine move when he changed the quantity of ‘supply’ or ‘demand’ for one or more of the goods, so that the prices were no longer in equilibrium?

- Gravity acts on the water so it finds the lowest level.

- Channels allow the water to seek out the lowest level, but restrict the ways in which it can flow.

All economic models have something equivalent to gravity, and a description of the kinds of movements that are possible. The equivalent of gravity is the assumption that, by taking one course of action over another, people are attempting to do as well as they can (according to some standard).

The analogy to the free movement of water in Fisher’s machine is that people are free to select different courses of action, rather than simply being told what to do. This is where economic incentives affect the choices we make. But we can’t do everything we want to do: not every channel is open to us.

Like many economic models, the one we use to explain the permanent technological revolution is based on the idea that people or firms respond to economic incentives. As we will see in Unit 4, people are motivated not only by the desire for material gain but also by love, hate, sense of duty, and desire for approval. But material comfort is an important motive, and economic incentives appeal to this motive.

When owners or managers of firms decide how many workers to hire, or when shoppers decide what and how much to buy, prices are going to be an important factor determining their decision. If prices are a lot lower in the discount supermarket than in the corner shop, and it is not too far away, then this will be a good argument for shopping in the supermarket rather than in the shop.

Relative prices

A third characteristic of many economic models is that we are often interested in ratios of things, rather than their absolute level. Economics focuses attention on alternatives and choices. If you are deciding where to shop, it is not the corner shop prices alone that matter, but rather the prices relative to those in the supermarket and relative to the costs of reaching the supermarket. If all of these were to rise by 5%, your decision probably wouldn’t change.

Relative prices are simply the price of one option relative to another. We often express relative price as the ratio of two prices. We will see that they matter a lot in explaining not just what shoppers (or consumers, as we usually call them) decide to buy, but why firms make the choices that they do. When we study the Industrial Revolution, you will see that the ratio of energy prices (the price of coal, for example, to power a steam engine), to the wage rate (the price of an hour of a worker’s time) plays an important part in the story.

Reservation positions and rents

Imagine that you have figured out a new way of reproducing sound in high quality. Your invention is much cheaper to use than anyone else’s method. Your competitors cannot copy you, either because they cannot figure out how to do it or because you have a patent on the process (making it illegal for them to copy you). So they continue offering their services at a price that is much higher than your costs.

If you match their price, or undercut them by just a bit, you will be able to sell as much as you can produce, so you can charge the same price but make profits that greatly exceed those of your competitors. In this case, we say that you are making an innovation rent. Innovation rents are a form of economic rent—and economic rents occur throughout the economy. They are one of the reasons why capitalism can be such a dynamic system.

We will use the idea of innovation rents to explain some of the factors contributing to the Industrial Revolution. But economic rent is a general concept that will help explain many other features of the economy.

When taking some action (call it action A) results in a greater benefit to yourself than the next best action, we say that you have received an economic rent.

The term is easily confused with everyday uses of the word, such as the rent for temporary use of a bicycle, apartment, or piece of land. To avoid this confusion, when we mean economic rent, we emphasize the word ‘economic’. Remember, an economic rent is something you would like to get, not something you have to pay.

- reservation option

- A person’s next best alternative among all options in a particular transaction. Also known as: fallback option. See also: reservation price.

The alternative action with the next greatest net benefit (action B), is often called the ‘next best alternative’, your ‘reservation position’, or the term we use: reservation option. It is ‘in reserve’ in case you do not choose A. Or, if you are enjoying A but then someone excludes you from doing it, your reservation option is your Plan B. This is why it is also called a ‘fallback option’.

Economic rent gives us a simple decision rule:

- If action A would give you an economic rent (and nobody else would suffer): Do it!

- If you are already doing action A, and it earns you an economic rent: Carry on doing it!

This decision rule motivates our explanation of why a firm may innovate by switching from one technology to another. We start in the next section by comparing technologies.

Question 2.2 Choose the correct answer(s)

Which of the following is an economic rent?

- This is the rent as used in everyday language. Economic rent is something you would like to get and not something you have to pay.

- An economic rent is what you earn above the next best alternative, which in this case may be the additional earnings compared to subletting the land to someone else at the same rate.

- This particular form of economic rent is called an innovation rent, where profits are made in excess of those offered by the next best alternative due to the adoption of new technology.

- This would be the normal profit you can earn in return for hard work. An economic rent is what you earn over and above the next best option, for example working really hard in another job.

2.4 Modelling a dynamic economy: Technology and costs

We now apply these modelling ideas to explain technological progress. In this section we consider:

- What is a technology?

- How does a firm evaluate the cost of different technologies?

What is a technology?

Suppose we ask an engineer to report on the technologies that are available to produce 100 metres of cloth, where the inputs are labour (number of workers, each working for a standard eight-hour day) and energy (tonnes of coal). The answer is represented in the diagram and table in Figure 2.3. The five points in the table represent five different technologies. For example, technology E uses 10 workers and 1 tonne of coal to produce 100 metres of cloth.

Follow the steps in Figure 2.3 so you can understand the five technologies.

We describe the E-technology as relatively labour-intensive and the A-technology as relatively energy-intensive. If an economy were using technology E and shifted to using technology A or B we would say that they had adopted a labour-saving technology, because the amount of labour used to produce 100 metres of cloth with these two technologies is less than with technology E. This is what happened during the Industrial Revolution.

- dominated

- We describe an outcome in this way if more of something that is positively valued can be attained without less of anything else that is positively valued. In short: an outcome is dominated if there is a win-win alternative.

Which technology will the firm choose? The first step is to rule out technologies that are obviously inferior. We begin in Figure 2.4 with the A-technology and look to see whether any of the alternative technologies use at least as much labour and coal. The C-technology is inferior to A: to produce 100 metres of cloth, it uses more workers (three rather than one) and more coal (7 tonnes rather than 6 tonnes). We say the C-technology is dominated by the A-technology: assuming all inputs must be paid for, no firm will use technology C when A is available. The steps in Figure 2.4 show you how to see which of the technologies are dominated, and which technologies dominate.

Using only the engineering information about inputs, we have narrowed down the choices: the C- and D-technologies would never be chosen. But how does the firm choose between A, B and E? This requires an assumption about what the firm is trying to do. We assume its goal is to make as much profit as possible, which means producing cloth at the least possible cost.

Making a decision about technology also requires economic information about relative prices—the cost of hiring a worker relative to that of purchasing a tonne of coal. Intuitively, the labour-intensive E-technology would be chosen if labour was very cheap relative to the cost of coal; the energy-intensive A-technology would be preferable in a situation where coal is relatively cheap. An economic model helps us be more precise than this.

How does a firm evaluate the cost of production using different technologies?

The firm can calculate the cost of any combination of inputs that it might use by multiplying the number of workers by the wage and the tonnes of coal by the price of coal. We use the symbol w for the wage, L for the number of workers, p for the price of coal and R for the tonnes of coal:

- isocost line

- A line that represents all combinations that cost a given total amount.

Suppose that the wage is £10 and the price of coal is £20 per tonne. In the table in Figure 2.5, we have calculated the cost of employing two workers and three tonnes of coal, which is £80. This corresponds to combination P1 in the diagram. If the firm were to employ more workers—say, six—but reduce the input of coal to one tonne (point P2), that would also cost £80. Follow the steps in Figure 2.5 to see how we construct isocost lines to compare the costs of all combinations of inputs.

Isocost lines join all the combinations of workers and coal that cost the same amount. We can use them to help us compare the costs of the three technologies A, B, and E that remain in play (that is, are not dominated).

The table in Figure 2.6 shows the cost of producing 100 metres of cloth with each technology when the wage is £10 and the price of coal is £20. Clearly the B-technology allows the firm to produce cloth at lower cost.

In the diagram, we have drawn the isocost line through the point representing technology B. This shows immediately that, at these input prices (remember that the wage is the ‘price’ of labour), the other two technologies are more costly.

| Technology | Number of workers | Coal required (tonnes) | Total cost (£) |

|---|---|---|---|

| B | 4 | 2 | 80 |

| A | 1 | 6 | 130 |

| E | 10 | 1 | 120 |

Wage £10, cost of coal £20 per tonne

Figure 2.6 The cost of using different technologies to produce 100 metres of cloth: Low relative cost of labour.

We can see from Figure 2.6 that B is the least-cost technology when w = 10 and p = 20. The other available technologies will not be chosen at these input prices. Notice that it is the relative price that matters and not the absolute price: if both prices doubled, the diagram would look almost the same: the isocost line through B would have the same slope, although the cost would be £160.

We can now represent the isocost lines for any wage w and coal price p as equations. To do this, we write c for the cost of production. We begin with the cost of production equation:

that is:

This is one way to write the equation of the isocost line for any value of c.

To draw an isocost line, it can help to express it in the form:

where a, which is a constant, is the vertical axis intercept and b is the slope of the line. In our model, tonnes of coal, R, are on the vertical axis, the number of workers, L, is on the horizontal axis and we shall see that the slope of the line is the wage relative to the price of coal, −(w/p). The isocost line slopes downward so the slope term in the equation −(w/p) is negative.

The equation:

can be rewritten as:

and further rearranged as:

So when w = 10 and p = 20, the isocost line for c = 80 has a vertical axis intercept of 80/20 = 4 and a negative slope equal to −(w/p) = −1/2. The slope is the relative price of labour.

Exercise 2.3 Isocost lines

Suppose the wage is £10 but the price of coal is only £5.

- What is the relative price of labour?

- Using the method in the text, write down the equation of the isocost line for c = £60, and rewrite it in the standard form y = a + bx.

- Write the equations for the £30 and £90 isocost lines in the standard form too, and draw all three lines on a diagram. How does the set of isocost lines for these input prices compare to the ones for w = 10 and p = 20?

2.5 Modelling a dynamic economy: Innovation and profit

We have seen that when the wage is £10 and the price of coal is £20, B is the least-cost technology.

Any change in the relative price of these two inputs will change the slope of the isocost lines. Looking at the positions of the three technologies in Figure 2.7, we can imagine that if the isocost line becomes sufficiently steep (with the wage rising relative to the cost of coal), B will no longer be the least-cost technology: the firm will switch to A. This is what happened in England in the eighteenth century.

Let’s look at how a change in relative prices could cause this to happen. Suppose that the price of coal falls to £5 while the wage remains at £10.

Looking at the table in Figure 2.7, with the new prices, the A-technology allows the firm to produce 100 metres of cloth at least cost. Cheaper coal makes each method of production cheaper, but the energy-intensive technology is now cheapest.

Remember that to draw the isocost line through any point, such as A, we calculate the cost at A (£40) then look for another point with the same cost. The easiest way is to find one of the end points F or G. For example, if no coal was used, four workers could be hired for £40. This is point F.

You can see from Figure 2.7 that with the new relative price the A-technology lies on the £40 isocost line, and the other two available technologies lie above it. They will not be chosen if the A-technology is available.

How does a cost-reducing innovation raise the profits of the firm?

The next step is to calculate the gains to the first firm to adopt the least-cost technology (A) when the relative price of labour to coal rises. Like all its competitors, the firm is initially using the B-technology and minimizing its costs: this is shown in Figure 2.8 by the dashed isocost line through B (with end points H and J).

Once the relative prices change, the new isocost line through the B-technology is steeper and the cost of production is £50. Switching to the A-technology (which is more energy-intensive and less labour-intensive) to produce 100 metres of cloth reduces costs to £40. Follow the steps in Figure 2.8 to see how isocost lines change with the new relative prices.

The firm’s profits are equal to the revenue it gets from selling output minus its costs.

Whether the new or old technology is used, the same prices have to be paid for labour and coal, and the same price is received for selling 100 metres of cloth. The change in profit is thus equal to the fall in costs associated with adopting the new technology, and profits rise by £10 per 100 metres of cloth:

In this case, the economic rent for a firm switching from B to A is £10 per 100 metres of cloth, which is the cost reduction made possible by the new technology. The decision rule (if the economic rent is positive, do it!) tells the firm to innovate.

- entrepreneur

- A person who creates or is an early adopter of new technologies, organizational forms, and other opportunities.

In our example, the A-technology was available, but not in use until a first-adopter firm responded to the incentive created by the increase in the relative price of labour. The first adopter is called an entrepreneur. When we describe a person or firm as entrepreneurial, it refers to a willingness to try out new technologies and to start new businesses.

The economist Joseph Schumpeter (see below) made the adoption of technological improvements by entrepreneurs a key part of his explanation for the dynamism of capitalism. This is why innovation rents are often called Schumpeterian rents.

Innovation rents will not last forever. Other firms, noticing that entrepreneurs are making economic rents, will eventually adopt the new technology. They will also reduce their costs and their profits will increase.

- creative destruction

- Joseph Schumpeter’s name for the process by which old technologies and the firms that do not adapt are swept away by the new, because they cannot compete in the market. In his view, the failure of unprofitable firms is creative because it releases labour and capital goods for use in new combinations.

In this case, with higher profits per 100 metres of cloth, the lower-cost firms will thrive. They will increase their output of cloth. As more firms introduce the new technology, the supply of cloth to the market increases and the price will start to fall. This process will continue until everyone is using the new technology, at which stage prices will have declined to the point where no one is earning innovation rents. The firms that stuck to the old B-technology will be unable to cover their costs at the new lower price for cloth, and they will go bankrupt. Joseph Schumpeter called this creative destruction.

Question 2.3 Choose the correct answer(s)

Figure 2.3 shows different technologies for producing 100 metres of cloth.

From the graph, what can we conclude?

- Technology D uses more workers and less coal, and therefore is more labour-intensive than C.

- Technology B uses fewer workers and fewer tonnes of coal than technology D to produce the same amount of cloth, so it dominates D.

- Technology A would be costlier than B, D or E if the price of coal were much higher than the wage level.

- Technology C is dominated by A as it uses both more workers and more coal than A. Therefore it can never be a cheaper technology than A.

Question 2.4 Choose the correct answer(s)

Look at the three isocost lines in Figure 2.8.

Based on this information, what can we conclude?

- At these prices, N and B are on the same isocost line. These two combinations of inputs cost the same.

- The price ratio is equal to the slope of an isocost; since isocosts MN and FG have the same slope, we can infer that they represent the same price ratio. MN is higher than FG, so represents higher total costs.

- Isocost FG has a slope of −2 (replacing two tonnes of coal with one worker leaves the total cost of production the same), while isocost HJ has slope −0.5 (replacing one tonne of coal with two workers leaves the total cost the same). This means that labour is relatively cheaper along HJ, or isocost HJ has a lower wage/price of coal ratio.

- An isocost represents all combinations of workers and tonnes of coal for which the total cost of production is the same. Along isocost HJ we know that at point B (4 workers and 2 tonnes of coal) the technology can produce 100 metres of cloth. If a technology were available to produce at another point on the line it would not necessarily produce 100 metres of cloth.

Great economists Joseph Schumpeter

- evolutionary economics

- An approach that studies the process of economic change, including technological innovation, the diffusion of new social norms, and the development of novel institutions.

Joseph Schumpeter (1883–1950) developed one of the most important concepts of modern economics: creative destruction.

Schumpeter brought to economics the idea of the entrepreneur as the central actor in the capitalist economic system. The entrepreneur is the agent of change who introduces new products, new methods of production, and opens up new markets. Imitators follow, and the innovation is diffused through the economy. A new entrepreneur and innovation launch the next upswing.

For Schumpeter, creative destruction was the essential fact about capitalism: old technologies and the firms that do not adapt are swept away by the new, because they cannot compete in the market by selling goods at a price that covers the cost of production. The failure of unprofitable firms releases labour and capital goods for use in new combinations.

This decentralized process generates a continued improvement in productivity, which leads to growth, so Schumpeter argued it is virtuous.9 Both the destruction of old firms and the creation of new ones take time. The slowness of this process creates upswings and downswings in the economy. The branch of economic thought known as evolutionary economics (you can read articles on the subject in the Journal of Evolutionary Economics) can clearly trace its origins to Schumpeter’s work, as well as most modern economic modelling that deals with entrepreneurship and innovation. Read Schumpeter’s ideas and opinions in his own words.10 11

Schumpeter was born in Austro-Hungary, but migrated to the US after the Nazis won the election in 1932 that led to the formation of the Third Reich in 1933. He had also experienced the First World War and the Great Depression of the 1930s, and died while writing an essay called ‘The march into socialism’, recording his concerns about the increasing role of government in the economy and the resulting ‘migration of people’s economic affairs from the private into the public sphere’. As a young professor in Austria he had fought and won a duel with the university librarian to ensure that students had access to books. He also claimed that as a young man he had three ambitions in life: to become the world’s greatest economist, the world’s greatest lover, and the world’s greatest horseman. He added that only the decline of the cavalry had stopped him from succeeding in all three.

2.6 The British Industrial Revolution and incentives for new technologies

Before the Industrial Revolution, weaving, spinning, and making clothes for the household were time-consuming tasks for most women. Single women were known as ‘spinsters’ because spinning was their primary occupation.

Eve Fisher, a historian, calculated that making a shirt at this time required 500 hours of spinning, and 579 hours of work in total—costing $4,197.25 at today’s minimum wage in the US.

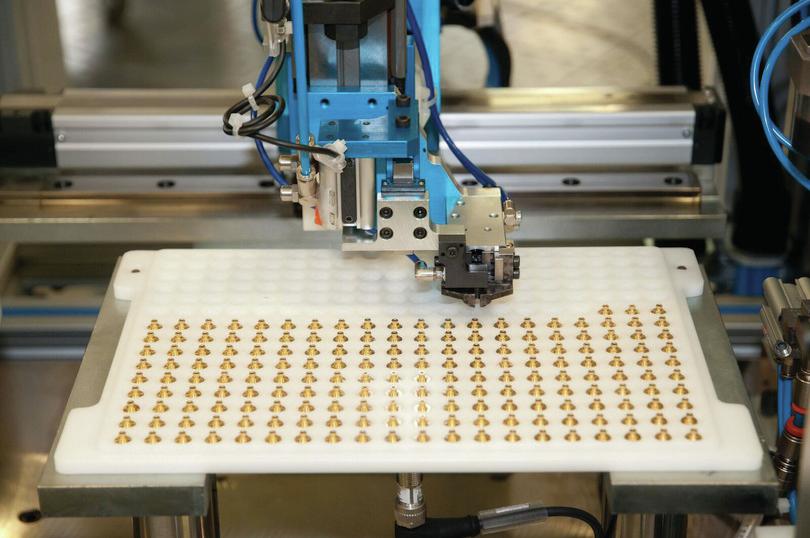

What did inventions such as the spinning jenny do? The first spinning jennies had eight spindles. One machine operated by just one adult therefore replaced eight spinsters working on eight spinning wheels. By the late nineteenth century, a single spinning mule operated by a very small number of people could replace more than 1,000 spinsters. These machines did not rely on human energy, but were powered first by water wheels, and later by coal-powered steam engines. Figure 2.9 summarizes these changes that happened in the Industrial Revolution.

| Old technology | New technology |

|---|---|

| Lots of workers | Few workers |

| Little machinery (spinning wheels) | Lots of capital goods (spinning mules, factory buildings, water wheels or steam engines) |

| … requiring only human energy | … requiring energy (coal) |

| Labour-intensive | Labour-saving |

| Capital-saving | Capital-intensive |

| Energy-saving | Energy-intensive |

Figure 2.9 The change in spinning technology during the Industrial Revolution.

The model in the previous section provides a hypothesis (potential explanation) for why someone would bother to invent such a technology, and why someone would want to use it. In this model, producers of cloth chose between technologies using just two inputs—energy and labour. This is a simplification, but it shows the importance of the relative costs of inputs for the choice of technology. When the cost of labour increased relative to the cost of energy, there were innovation rents to be earned from a switch to the energy-intensive technology.

This is just a hypothesis. Is it actually what happened? Looking at how relative prices differed among countries, and how they changed over time, can help us understand why technologies such as the spinning jenny were invented in Britain rather than elsewhere, and in the eighteenth century rather than at an earlier time.

Figure 2.10 Wages relative to the price of energy (early 1700s).

Page 140 of Robert C. Allen. 2008. The British Industrial Revolution in Global Perspective. Cambridge: Cambridge University Press.

Figure 2.10 shows the price of labour relative to the price of energy in various cities in the early 1700s—specifically, the wages of building labourers divided by the price of 1 million BTU (British Thermal Units, a unit of energy equivalent to slightly more than 1,000 joules). You can see that labour was more expensive relative to the cost of energy in England and the Netherlands than in France (Paris and Strasbourg), and much more so than in China.

Wages relative to the cost of energy were high in England, both because English wages were higher than wages elsewhere, and because coal was cheaper in coal-rich Britain than in the other countries in Figure 2.10.

Figure 2.11 Wages relative to the cost of capital goods (late sixteenth to the early nineteenth century).

Page 138 in Robert C. Allen. 2008. The British Industrial Revolution in Global Perspective. Cambridge: Cambridge University Press.

Figure 2.11 shows trends in the cost of labour relative to the cost of capital goods in England and France, from the late sixteenth to the early nineteenth century. It shows the wages of building labourers divided by the cost of using capital goods. This cost is calculated from the prices of metal, wood, and brick, the cost of borrowing, and takes account of the rate at which the capital goods wear out, or depreciate.

As you can see, wages relative to the cost of capital goods were similar in England and France in the mid-seventeenth century but from then on, in England but not in France, workers became steadily more expensive relative to capital goods. In other words, the incentive to replace workers with machines was increasing in England during this time, but this was not true in France. In France, the incentive to save labour by innovating had been stronger during the late sixteenth century than it was 200 years later, at the time the Industrial Revolution began to transform Britain.

From the model in the previous section we learned that the technology chosen depends on relative input prices. Combining the predictions of the model with the historical data, we have one explanation for the timing and location of the Industrial Revolution:

- Wages relative to the cost of energy and capital goods rose in the eighteenth century in Britain compared with earlier historical periods.

- Wages relative to the cost of energy and capital goods were higher in Britain during the eighteenth century than elsewhere.

No doubt it helped, too, that Britain was such an inventive country. There were many skilled workmen, engineers and machine makers who could build the machines that inventors designed.

Exercise 2.4 Britain but not France

Watch our video in which Bob Allen, an economic historian, explains his theory of why the Industrial Revolution occurred when and where it did.

- Summarize Allen’s claim using the concept of economic rents. Which ceteris paribus assumptions are you making?

- What other important factors may explain the rise of energy-intensive technologies in Britain in the eighteenth century?

The relative prices of labour, energy and capital can help to explain why the labour-saving technologies of the Industrial Revolution were first adopted in England, and why at that time technology advanced more rapidly there than on the continent of Europe, and even more rapidly compared with Asia.

What explains the eventual adoption of these new technologies in countries like France and Germany, and ultimately China and India? One answer is further technological progress, where a new technology is developed that dominates the existing one in use. Technological progress would mean that it would take smaller quantities of inputs to produce 100 metres of cloth. We can use the model to illustrate this. In Figure 2.13, technological progress leads to the invention of a superior energy-intensive technology, labelled A′. The analysis in Figure 2.13 shows that once the A′-technology is available, it would be chosen both in countries using A, and in those using B.

A second factor that promoted the diffusion across the world of the new technologies was wage growth and falling energy costs (due, for example, to cheaper transportation, allowing countries to import energy cheaply from abroad). This made isocost lines steeper in poor countries, again providing an incentive to switch to a labour-saving technology.12

Either way, the new technologies spread, and the divergence in technologies and living standards was eventually replaced by convergence—at least among those countries where the capitalist revolution had taken off.13

Nevertheless, in some countries we still observe the use of technologies that were replaced in Britain during the Industrial Revolution. The model predicts that the relative price of labour must be very low in such situations, making the isocost line very flat. The B-technology could be preferred in Figure 2.13 even when the A′-technology is available if the isocost line is flatter than HJ, so that it goes through B but below A′.

Question 2.5 Choose the correct answer(s)

Look again at Figure 2.12 which depicts isocost lines for the 1600s and the 1700s in Britain.

Which of the following is true?

- The slope of the isocost line is the negative of the price ratio, −(wage/price of coal). A flatter isocost line indicates lower wages relative to the price of coal.

- An increase in the level of wages relative to the cost of energy would lead to a steeper isocost line.

- The relative price matters, not the absolute level. So if wages fall, but by relatively less than the energy costs so that the price ratio still increases, then technology A may still be the better choice.

- The comparison between these two lines shows that that the cost of producing is lower at A than at B. Therefore, firms adopting technology A enjoy some profit in excess of that which they earned with the alternative: an innovation rent.

Exercise 2.5 Why did the Industrial Revolution not happen in Asia?

Read David Landes’ answer to this question, and this summary of research on the great divergence to discuss why the Industrial Revolution happened in Europe rather than in Asia, and in Britain rather than in Continental Europe.

- Which arguments do you find most persuasive, and why?

- Which arguments do you find least persuasive, and why?

2.7 Malthusian economics: Diminishing average product of labour

The historical evidence supports our model that uses relative prices and innovation rents to provide a simple account of the timing and the geographical spread of the permanent technological revolution.14

This is part of the explanation of the upward kink in the hockey stick. Explaining the long flat part of the stick is another story, requiring a different model.

Malthus provided a model of the economy that predicts a pattern of economic development consistent with the flat part of the GDP per capita hockey stick from Figure 1.1a in Unit 1. His model introduces concepts that are used widely in economics. One of the most important concepts is the idea of diminishing average product of a factor of production.

Diminishing average product of labour

To understand what this means, imagine an agricultural economy that produces just one good, grain. Suppose that grain production is very simple—it involves only farm labour, working on the land. In other words, ignore the fact that grain production also requires spades, combine harvesters, grain elevators, silos, and other types of buildings and equipment.

- factors of production

- The labour, machinery and equipment (usually referred to as capital), land, and other inputs to a production process.

Labour and land (and the other inputs that we are ignoring) are called factors of production, meaning inputs into the production process. In the model of technological change above, the factors of production are energy and labour.

- average product

- Total output divided by a particular input, for example per worker (divided by the number of workers) or per worker per hour (total output divided by the total number of hours of labour put in).

We will use a further simplifying ceteris paribus assumption: that the amount of land is fixed and all of the same quality. Imagine that the land is divided into 800 farms, each worked by a single farmer. Each farmer works the same total hours during a year. Together, these 800 farmers produce a total of 500,000 kg of grain. The average product of a farmer’s labour is:

Production function

This describes the relationship between the amount of output produced and the amounts of inputs used to produce it.

To understand what will happen when the population grows and there are more farmers on the same limited space of farmland, we need something that economists call the production function for farming. This indicates the amount of output produced by any given number of farmers working on a given amount of land. In this case, we are holding constant all of the other inputs, including land, so we only consider how output varies with the amount of labour.

In the previous sections, you have already seen very simple production functions that specified the amounts of labour and energy necessary to produce 100 metres of cloth. For example, in Figure 2.3, the production function for technology B says that if 4 workers and 2 tonnes of coal are put into production, 100 metres of cloth will be the output. The production function for technology A gives us another ‘if-then’ statement: if 1 worker and 6 tonnes of coal are put into production using this technology, then 100 metres of cloth will be the output. The grain production function is a similar ‘if-then’ statement, indicating that if there are X farmers, then they will harvest Y grain.

Figure 2.14a lists some values of labour input and the corresponding grain production. In the third column we have calculated the average product of labour. In Figure 2.14b, we draw the function, assuming that the relationship holds for all farmers and grain production amounts in between those shown in the table.

Leibniz: Malthusian Economics: Diminishing Average Product of Labour

We call this a production function because a function is a relationship between two quantities (inputs and outputs in this case), expressed mathematically as:

We say that ‘Y is a function of X’. X in this case is the amount of labour devoted to farming. Y is the output in grain that results from this input. The function f(X) describes the relationship between X and Y, represented by the curve in the figure.

| Labour input (number of workers) | Grain output (kg) | Average product of labour (kg/worker) |

|---|---|---|

| 200 | 200,000 | 1,000 |

| 400 | 330,000 | 825 |

| 600 | 420,000 | 700 |

| 800 | 500,000 | 625 |

| 1,000 | 570,000 | 570 |

| 1,200 | 630,000 | 525 |

| 1,400 | 684,000 | 490 |

| 1,600 | 732,000 | 458 |

| 1,800 | 774,000 | 430 |

| 2,000 | 810,000 | 405 |

| 2,200 | 840,000 | 382 |

| 2,400 | 864,000 | 360 |

| 2,600 | 882,000 | 340 |

| 2,800 | 894,000 | 319 |

| 3,000 | 900,000 | 300 |

Figure 2.14a Recorded values of a farmer’s production function: Diminishing average product of labour.

Exercise 2.6 The farmers’ production function

In Unit 1 we explained that the economy is part of the biosphere. Think of farming biologically.

- Find out how many calories a farmer burns, and how many calories are contained in 1 kg of grain.

- Does farming produce a surplus of calories—more calories in the output than used up in the work input—using the production function in Figure 2.14b?

Our grain production function is hypothetical, but it has two features that are plausible assumptions about how output depends on the number of farmers:

Labour combined with land is productive. No surprises there. The more farmers there are, the more grain is produced; at least up to a certain point (3,000 farmers, in this case).

- diminishing average product of labour

- A situation in which, as more labour is used in a given production process, the average product of labour typically falls.

As more farmers work on a fixed amount of land, the average product of labour falls. This diminishing average product of labour is one of the two foundations of Malthus’ model.

Remember that the average product of labour is the grain output divided by the amount of labour input. From the production function in Figure 2.14b, or the table in Figure 2.14a (both show the same information) we see that an annual input of 800 farmers working the land brings an average per-farmer output of 625 kg of grain, while increasing the labour input to 1,600 farmers produces an average output per farmer of 458 kg. The average product of labour falls as more labour is expended on production. This worried Malthus.

To see why he was worried, imagine that, a generation later, each farmer has had many children, so that instead of a single farmer working each farm, there are now two farmers working. The total labour input into farming was 800, but is now 1,600. Instead of a harvest of 625 kg of grain per farmer, the average harvest is now only 458 kg.

You might argue that in the real world, as the population grows, more land can be used for farming. But Malthus pointed out that earlier generations of farmers would have picked the best land, so any new land would be worse. This also reduces the average product of labour.

So diminishing average product of labour can be caused by:

- more labour devoted to a fixed quantity of land

- more (inferior) land brought into cultivation

Because the average product of labour diminishes as more labour is devoted to farming, their incomes inevitably fall.

Question 2.6 Choose the correct answer(s)

Look again at Figure 2.14b which depicts the production function of grain for farmers under average growing conditions with the currently available technology.

We can ascertain that:

- Zero farmers means zero output. Therefore, all curves must start at the origin, and cannot shift upwards or downwards in a parallel manner.

- Such a discovery would increase the kilogrammes of grain produced for any given number of farmers (except zero); this can be represented graphically as an anti-clockwise pivot in the production function curve.

- A downward-sloping curve implies decreasing output as the number of farmers increases. This would only be the case if the additional labourers have negative effects on the productivity of the existing labourers, which we normally rule out.

- An upper limit implies that additional farmers would not yield any additional kilogrammes of grain, which would be represented graphically by a flat production function past the upper limit.

2.8 Malthusian economics: Population grows when living standards rise

On its own, the diminishing average product of labour does not explain the long, flat portion of the hockey stick. It just means that living standards depend on the size of the population. It doesn’t say anything about why, over long periods, living standards and population didn’t change much. For this we need the other part of Malthus’s model: his argument that increased living standards create a population increase.

Malthus was not the first person to have this idea. Years before Malthus developed his theories, Richard Cantillon, an Irish economist, had stated that, ‘Men multiply like mice in a barn if they have unlimited means of subsistence.’

Malthusian theory essentially regarded people as being not that different from other animals:

Elevated as man is above all other animals by his intellectual facilities, it is not to be supposed that the physical laws to which he is subjected should be essentially different from those which are observed to prevail in other parts of the animated nature.15

So the two key ideas in Malthus’ model are:

- the law of diminishing average product of labour

- population expands if living standards increase

Imagine a herd of antelopes on a vast and otherwise empty plain. Imagine also that there are no predators to complicate their lives (or our analysis). When the antelopes are better fed, they live longer and have more offspring. When the herd is small, the antelopes can eat all they want, and the herd gets larger.

Eventually the herd will get so large relative to the size of the plain that the antelopes can no longer eat all they want. As the amount of land per animal declines, their living standards will start to fall. This reduction in living standards will continue as long as the herd continues to increase in size.

Since each animal has less food to eat, the antelopes will have fewer offspring and die younger so population growth will slow down. Eventually, living standards will fall to the point where the herd is no longer increasing in size. The antelopes have filled up the plain. At this point, each animal will be eating an amount of food that we will define as the subsistence level. When the animals’ living standards have been forced down to subsistence level as a result of population growth, the herd is no longer getting bigger.

If antelopes eat less than the subsistence level, the herd starts to get smaller. And when consumption exceeds the subsistence level, the herd grows.

Much of the same logic would apply, Malthus reasoned, to a human population living in a country with a fixed supply of agricultural land. While people are well-fed they would multiply like Cantillon’s mice in a barn; but eventually they would fill the country, and further population growth would push down the incomes of most people as a result of diminishing average product of labour. Falling living standards would slow population growth as death rates increased and birth rates fell; ultimately incomes would settle at the subsistence level.

Malthus’s model results in an equilibrium in which there is an income level just sufficient to allow a subsistence level of consumption. The variables that stay constant in this equilibrium are:

- the size of the population

- the income level of the people

If conditions change, then population and incomes may change too, but eventually the economy will return to an equilibrium with income at subsistence level.

Exercise 2.7 Are people really like other animals?

Malthus wrote: ‘[I]t is not to be supposed that the physical laws to which [mankind] is subjected should be essentially different from those which are observed to prevail in other parts of the animated nature.’

Do you agree? Explain your reasoning.

Malthusian economics: The effect of technological improvement

We know that over the centuries before the Industrial Revolution, improvements in technology occurred in many regions of the world, including Britain, and yet living standards remained constant. Can Malthus’ model explain this?

Figure 2.15 illustrates how the combination of diminishing average product of labour and the effect of higher incomes on population growth mean that in the very long run, technological improvements will not result in higher income for farmers. In the figure, things on the left are causes of things to the right.

Figure 2.15 Malthus’ model: The effect of an improvement in technology.

Beginning from equilibrium, with income at subsistence level, a new technology such as an improved seed raises income per person on the existing fixed quantity of land. Higher living standards lead to an increase in population. As more people are added to the land, diminishing average product of labour means average income per person falls. Eventually incomes return to subsistence level, with a higher population.

Why is the population higher at the new equilibrium? Output per farmer is now higher for each number of farmers. Population does not fall back to the original level, because income would be above subsistence. A better technology can provide subsistence income for a larger population.

The Einstein at the end of this section shows how to represent Malthus’ model graphically, and how to use it to investigate the effect of a new technology.

The Malthusian model predicts that improvements in technology will not raise living standards if:

- the average product of labour diminishes as more labour is applied to a fixed amount of land

- population grows in response to increases in real wages

Then in the long run, an increase in productivity will result in a larger population but not higher wages. This depressing conclusion was once regarded as so universal and inescapable that it was called Malthus’ Law.

Einstein Modelling Malthus

Malthus’s argument is summarized in Figure 2.16, using two diagrams.

The downward-sloping line in the left-hand figure shows that the higher the population, the lower the level of wages, due to the diminishing average product of labour. The upward-sloping line on the right shows the relationship between wages and population growth. When wages are high, population grows, because higher living standards lead to more births and fewer deaths.

The two diagrams together explain the Malthusian population trap. Population will be constant when the wage is at subsistence level, it will rise when the wage is above subsistence level, and it will fall when the wage is below subsistence level.

Figure 2.17 shows how the Malthusian model predicts that even if productivity increases, living standards in the long run do not.

Exercise 2.8 Living standards in the Malthusian world

Imagine that the population growth curve in the right panel of Figure 2.16 shifted to the left (with fewer people being born, or more people dying, at any level of wages). Explain what would happen to living standards describing the transition to the new equilibrium.

2.9 The Malthusian trap and long-term economic stagnation

The major long-run impact of better technology in this Malthusian world was therefore more people. The writer H. G. Wells, author of War of the Worlds, wrote in 1905 that humanity ‘spent the great gifts of science as rapidly as it got them in a mere insensate multiplication of the common life’.

So we now have a possible explanation of the long, flat portion of the hockey stick. Human beings periodically invented better ways of making things, both in agriculture and in industry, and this periodically raised the incomes of farmers and employees above subsistence. The Malthusian interpretation was that higher real wages led young couples to marry earlier and have more children, and they also led to lower death rates. Population growth eventually forced real wages back to subsistence levels, which might explain why China and India, with relatively sophisticated economies at the time, ended up with large populations but—until recently—very low incomes.

As with our model of innovation rents, relative prices and technological improvements, we need to ask: can we find evidence to support the central prediction of the Malthusian model, that incomes will return to subsistence level?